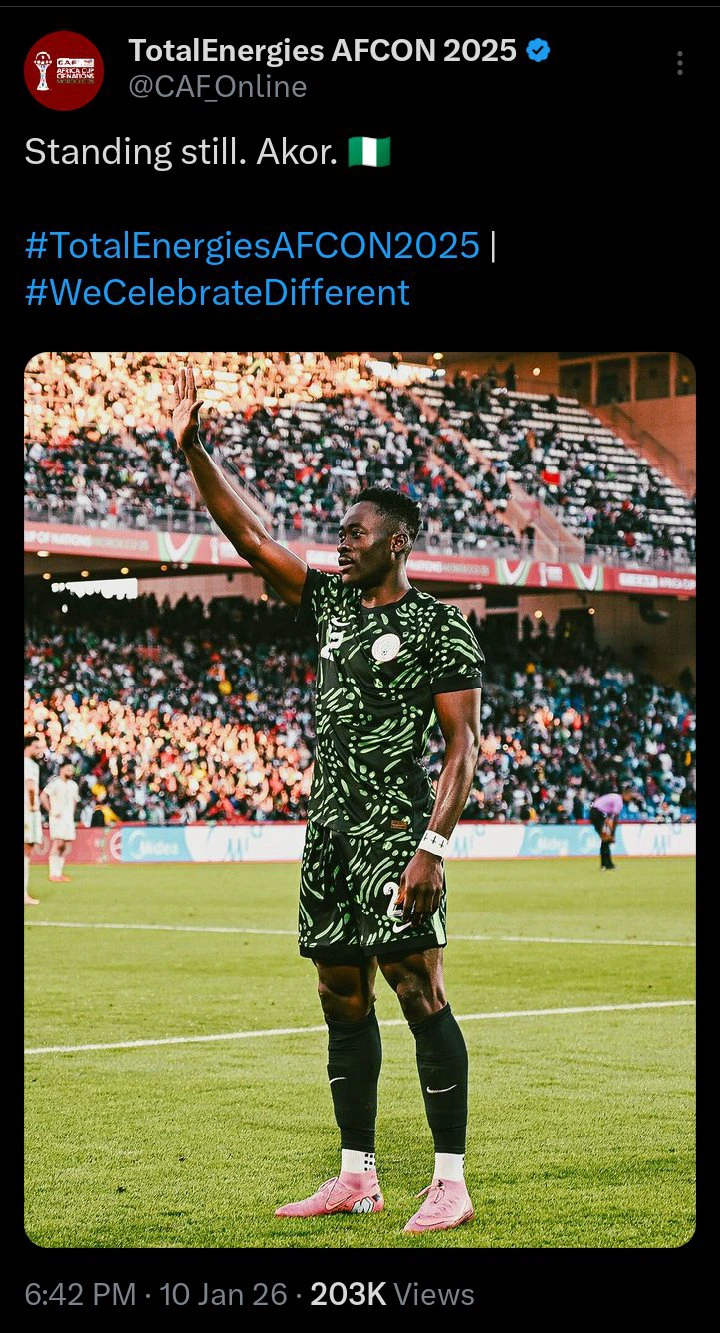

The Confederation of African Football (CAF) has publicly acknowledged Super Eagles striker Akor Adams following his goal celebration in Nigeria’s 2-0 quarter-final win over Algeria at the 2025 Africa Cup of Nations.

Adams scored Nigeria’s second goal against the Desert Foxes, making amends for earlier missed chances and helping the Super Eagles secure a place in the semifinals.

However, it was his celebration, rather than the finish itself, that drew widespread attention across the continent.

Tribute to DR Congo superfan

After finding the net, the Sevilla forward marked the moment with a gesture inspired by DR Congo superfan Mboladinga ‘Lumumba’.

The Congolese supporter has become a familiar figure at the tournament for standing throughout all DR Congo matches as a tribute to the legacy of former prime minister Patrice Lumumba.

Adams’ celebration mirrored Mboladinga’s stance, a move widely interpreted as a sign of respect and solidarity beyond national lines. The moment resonated with fans and officials alike, quickly gaining traction on social media.

CAF Reaction and fan response

CAF highlighted the gesture on its official X account, sharing an image of Adams’ celebration alongside a brief but pointed message. “Standing still. Akor.,” the continental body wrote.

The post prompted a wave of reactions from football fans across Africa. A user identified as @MrChirenga commented, “Love the fact that Africans are becoming more and more united fam … Love from Zimbabwe.”

Another fan, @abuagoody, praised Adams’ qualities, writing, “Such an impressive player. The last players that played like him for Nigeria are John Utaka, Brown Ideye and Uche.”

Others focused on Adams’ technical ability, with @MouxCaa adding, “Akor Adams is a type of player you see touching the ball and you automatically know it’s a professional footballer.”