The final verdict on tomorrow’s full take-off of the tax laws came yesterday.

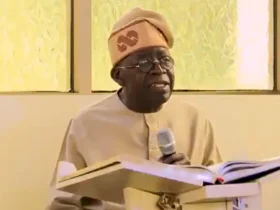

President Bola Ahmed Tinubu reaffirmed that the date is sacrosanct.

His position, made known in a statement, gave a stamp to Minister for Information and National Orientation Mohammed Idris’ earlier statement that there was no going back on the January 1 commencement date.

Following the observation by House of Representatives member Abdussamad Dasuki (PDP Sokoto) that the Gazetted version of the law is different from the copy passed by the National Assembly, opposition figures and some interest groups that have always opposed the tax reform process began agitating for the suspension of the laws’ takeoff.

But Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, argued that it was too late in the day to stop the law because two of the four tax laws were already operational, arguing that the remaining two are billed to begin tomorrow.

The President declared that the reforms represent a historic reset of the country’s fiscal architecture and not an attempt to impose higher taxes on citizens.

In a statement personally signed by him, he said the tax reforms were “a once-in-a-generation opportunity to build a fair, competitive and robust fiscal foundation for Nigeria”.

He stressed that the implementation phase would proceed as scheduled despite public controversy.

President Tinubu said: “The new tax laws, including those that took effect on June 26, 2025, and the remaining acts scheduled to commence on January 1, 2026, will continue as planned.”

He emphasised that the reforms were not revenue-hunting measures but a deliberate effort to harmonise Nigeria’s fragmented tax system, reduce duplication across tiers of government, and strengthen trust between citizens and the state.

The President said: “The tax laws are not designed to raise taxes, but rather to support a structural reset, drive harmonisation, and protect dignity while strengthening the social contract.

“I urge all stakeholders – state governments, businesses, labour unions and professional bodies –to support the implementation phase, which is now firmly in the delivery stage.”

President Tinubu’s comments came amid sustained criticism over allegations that some provisions of the tax laws were altered after passage by the National Assembly.

Some groups had faulted the discrepancies between versions passed by lawmakers and those later gazetted, prompting calls for a suspension of the laws.

Rejecting such demands, the President said no material irregularity had been established to justify halting a comprehensive reform process.

“Our administration is aware of the public discourse surrounding alleged changes to some provisions of the recently enacted tax laws.

“No substantial issue has been established that warrants a disruption of the reform process,” he said.

Warning against what he described as reactive governance, President Tinubu added: “Absolute trust is built over time through making the right decisions, not through premature, reactive measures.”

He nevertheless reassured Nigerians of his commitment to due process, pledging continued engagement with the National Assembly to resolve any genuine issues that may arise during implementation.

President Tinubu said: “I emphasise our administration’s unwavering commitment to due process and the integrity of enacted laws.

“We will work with the National Assembly to ensure the swift resolution of any issue identified.

“The Federal Government will continue to act in the overriding public interest to ensure a tax system that supports prosperity and shared responsibility.”

The opposition Peoples Democratic Party (PDP) disagreed, urging the President to suspend the implementation and “listen to the voice of Nigerians.”

In a statement yesterday, the Turaki-led PDP faction accused the Tinubu administration of prioritising revenue over citizens’ welfare, citing alleged “dangerous provisions” purportedly smuggled into the laws.

The PDP warned that insisting on the January 1 start date despite unresolved discrepancies “clearly shows where the priority of the government lies – between Nigerians and money”.

It reminded the President that democratic obedience to laws depends on public trust in the legislative process.

President Tinubu, on assumption of office, initiated a comprehensive reform of the tax regime in the country.

He set up a presidential panel to put together a new system of taxation after consultations across the country.

At the end of the panels’ work, four tax reform Bills were forwarded to the National Assembly.

The proposal drew flak from North’s political leaders and governors, who expressed open opposition to tax reform.

The National Economic Council advised the President to withdraw the Bills from the lawmakers to allow for wider consultation, but the President refused, urging those who had misgivings to table them before the lawmakers during the public hearing.

Opposition figures also seized the opportunity to disparage the government, but the President was unyielding.

The Bills were eventually passed by both chambers of the National Assembly – House of Representatives on March 18 and Senate on May 7. The President signed the Bills on May 26.

The implementation started in June with two of the laws.

Another round of opposition to the laws came after a lawmaker alleged differences in the version passed by the lawmakers and the law he gazette.

NECA backs implementation of new tax legislation

The Nigeria Employers’ Consultative Association (NECA) expressed support for the implementation of new tax legislation.

At a news conference in Lagos yesterday, NECA’s Director-General of NECA, Mr. Wale Smatt-Oyerinde, commended the presidential committee for constructively engaging with all stakeholders, in spite of efforts to misinform the Nigerian populace on its intention.

He urged the Federal Inland Revenue Service (FIRS) to collaborate with the organised private sector in a bid to deepen awareness of the new tax laws.

The NECA boss said the tax reform legislation remained a significant item that had witnessed the most excellent form of organised chaos in Nigeria’s political history.

He urged the Federal Government to proceed with the implementation of the laws, as the issue of alteration raised by the National Assembly is not sufficient to hinder it, considering its economic objectives.

Smart-Oyerinde said: “We cannot continue to run the system the way it was run with a lot of inconsistencies. No law is perfect, and that is why we have made provisions for amendments.

“As we proceed, we can make necessary amendments, and by doing so, we are building an institution.”

He said the tax laws were aimed at creating a more conducive and productive business environment for the private sector, thereby generating jobs that would address the root cause of insecurity in Nigeria.

Smatt-Oyerinde said the stiff resistance faced by the reforms alone was an indication that some forces were against the growth of the Nigerian economy.

He said: “I have never seen a regulation or legislation that witnessed this kind of engagement or antagonism; I also probably have not seen an item in our lives that has witnessed this kind of organised chaos.”

“However, the committee has done tremendous work, moving from one place to another.

“We all saw the issues, until two weeks ago, when it was alleged that the version gazetted was different from the one passed by the National Assembly.”

He urged that the tax legislation be allowed to run seamlessly, for the betterment of the nation.