By Ojukwu Emmanuel Chiadikaobi

The Nigerian naira has experienced a significant surge in value on the black market in Lagos and Kwara State, trading between N900 and N1,210 against the US dollar as of Wednesday. This remarkable turnaround is attributed to recent actions taken by the Central Bank of Nigeria (CBN) and subsequent developments in the currency exchange market.>>>>>>READ FULL CONTENT

The CBN’s intervention, spearheaded by Hassan Mahmud, the director of the trade and exchange department, has played a pivotal role in this surge. On Monday, the CBN allocated $10,000 to each registered bureau de change (BDC) operator at a favorable rate of N1,251 per dollar. Furthermore, BDC operators are required to maintain a profit margin not exceeding 1.5 percent when selling dollars, reinforcing the CBN’s efforts to stabilize the local currency.

This proactive measure has not only bolstered the naira’s position on the black market but has also had a ripple effect on the import and export (I&E) window, further enhancing the currency’s value.

BREAKING: Daily FX Turnover Hits Record High of $857M, as Gains Momentum

To delve deeper into the impact of these developments, FIJ (Foundation for Investigative Journalism) engaged with BDC operators in Lagos and Kwara State. Olalode, a currency exchanger based in Ilorin, disclosed a buying rate of N1,210 per dollar, showcasing the immediate impact of the CBN’s intervention. Similarly, Hussaini, operating in Lagos, acknowledged the market’s volatility but ultimately settled on a buying rate ranging from N900 to N910 per dollar.

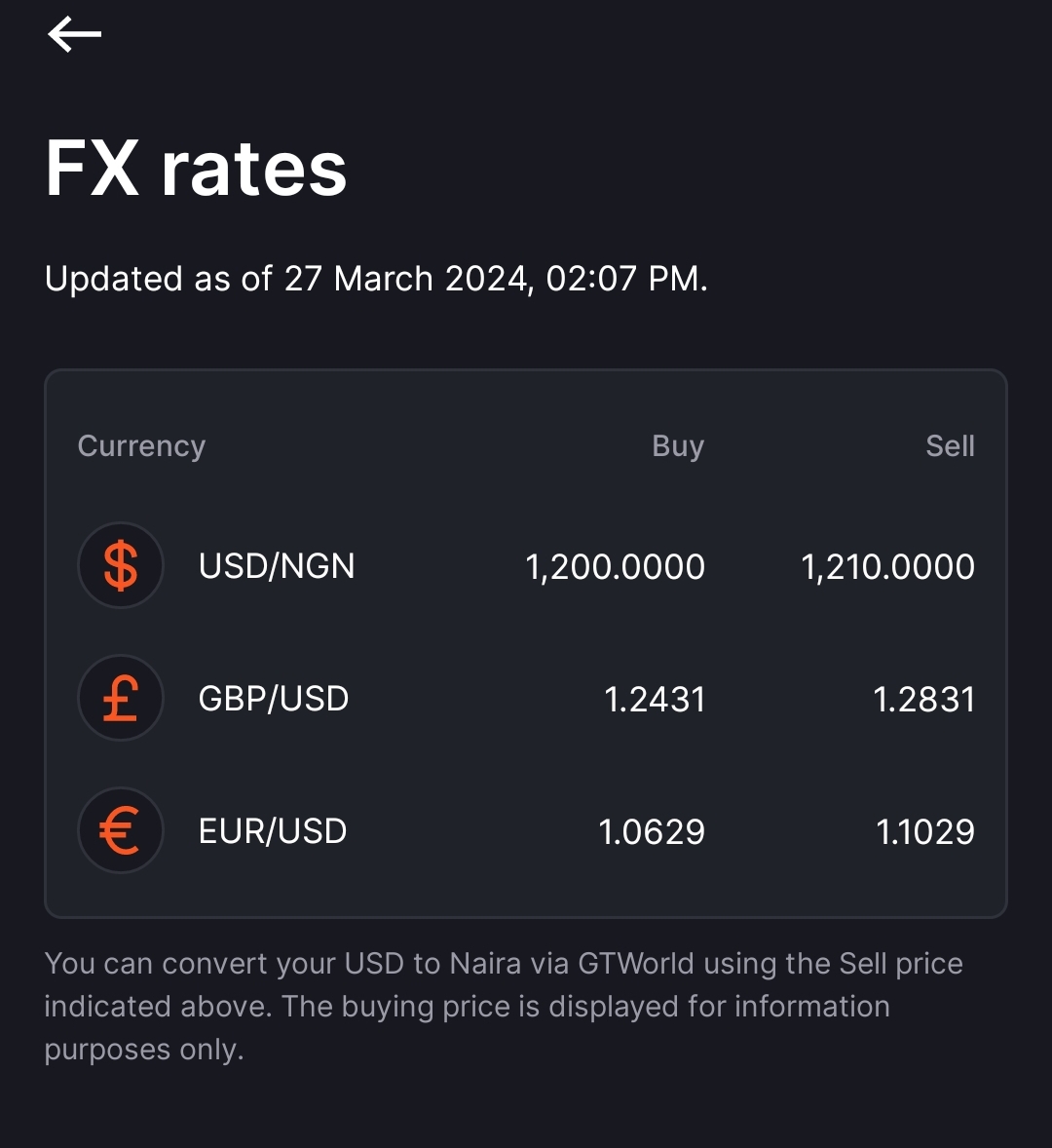

The fluctuating nature of black market rates highlights the intricate dynamics influenced by both buyer-seller negotiations and official CBN interventions. Platforms such as GTWorld FX of Guaranty Trust Bank (GTB) and Naira Rates on X also reflect varying exchange rates, underscoring the ongoing turbulence in the currency market.

Even If the Heaven Falls, 5 Biggest Secrets A Woman Will Never Tell You

Beyond the financial sector, the effects of currency fluctuations extend to government service providers like the Nigeria Customs Service (NCS). With the naira’s volatility, the NCS has found it necessary to adjust foreign exchange rates for import duties and cargo clearance multiple times within a short span, underscoring the broader ramifications of currency instability on economic operations.

and Prior to the CBN’s intervention, the naira faced significant devaluation, trading between N1500 and N1,600 against the US dollar. This stark contrast underscores the effectiveness of the recent measures implemented by the CBN in stabilizing the currency and curbing excessive depreciation.

The recent surge in the value of the naira on the black market, coupled with interventions by the Central Bank of Nigeria, reflects the complex dynamics at play within the currency exchange market. While these measures have temporarily bolstered the naira’s position, sustained efforts and proactive policies will be essential to ensure long-term stability and resilience against external economic pressures.>>>>>>READ FULL CONTENT